Indices trading, a cornerstone of modern financial markets, has witnessed the spectacular rise and fall of global stock markets over the years.

In this article, you can delve into the dynamics that have shaped these markets and their impact on traders and investors.

The phenomenon of indices trading

Indices trading, often referred to as stock market indices trading, is a practice that involves speculating on the price movements of market indices, such as the S&P 500, NASDAQ or FTSE 100.

These indices represent a composite of individual stocks, offering traders an opportunity to gain exposure to the overall performance of a market or sector without trading individual securities.

The rise: A tale of economic expansion

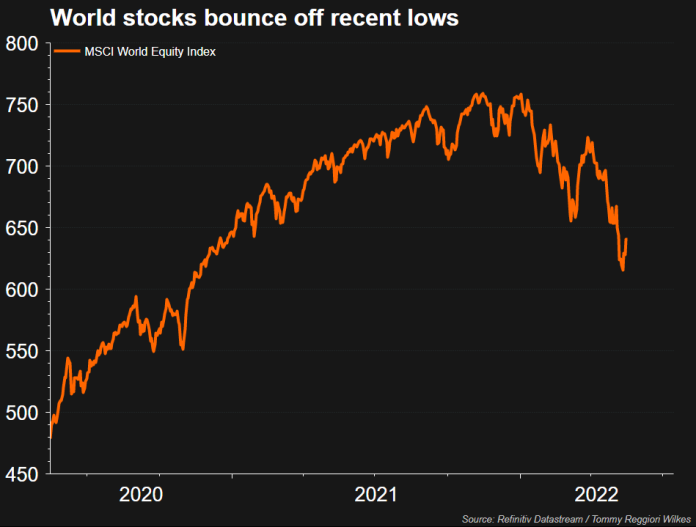

Global stock markets have experienced remarkable growth over the years, driven by various factors. Economic expansion, technological advances, and investor optimism have fueled bullish sentiments, leading to consistent upward trends in market indices.

Key milestones, such as the dot-com boom of the late 1990s and the global financial markets’ recovery following the 2008 recession, have contributed to this rise.

Indices trading has played a pivotal role in capturing and capitalizing on these upward movements. Traders and investors utilize indices as a means to diversify their portfolios, manage risk, and participate in the growth potential of global markets.

The fall: Volatility and market corrections

Despite the prolonged periods of prosperity, global stock markets are not immune to volatility and market corrections. Events such as economic downturns, geopolitical tensions, and unexpected global crises can trigger sharp declines in market indices.

The most notable example in recent history is the COVID-19 pandemic, which sent shockwaves through global markets in 2020, leading to severe drops in indices worldwide.

While these downturns can be daunting, they also present opportunities for skilled traders. Short-selling and hedging strategies become crucial during bearish market conditions, allowing traders to profit from falling prices or protect their portfolios.

A unique offering

In the ever-evolving landscape of global finance, Nigerian brokers with no deposit bonuses have emerged as a unique offering in the brokerage industry. These brokers provide traders with a chance to start trading without requiring an initial deposit. Instead, they offer a bonus amount to fund trading activities.

This innovative approach has garnered significant attention and appeal among traders, especially those who are new to the financial markets. It allows them to experience live trading conditions, test trading strategies, and explore the dynamics of indices trading without risking their capital upfront.

No deposit bonuses typically come with terms and conditions, including minimum trading volumes and withdrawal restrictions. While they provide an excellent opportunity for traders to get a feel for the market, it’s crucial to thoroughly understand and comply with the broker’s bonus policy.

Conclusion

The rise and fall of global stock markets are emblematic of the complex and interconnected nature of the financial world. Indices trading has been a key player in capturing the opportunities and mitigating the risks associated with these market movements.

Meanwhile, Nigerian brokers offering no deposit bonuses have brought an innovative dimension to trading, opening doors for traders to participate in global markets with minimal financial commitment upfront.