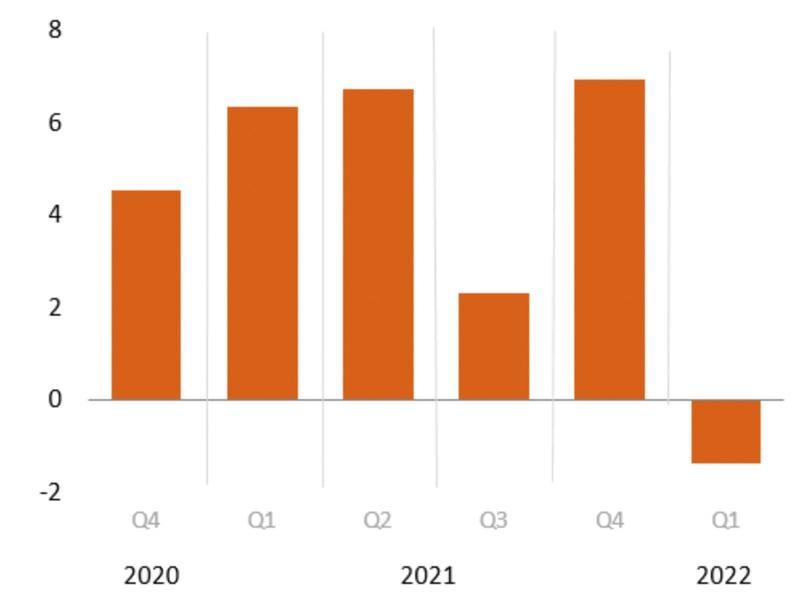

The US economy suffered a major slump in the first three months of this year, contracting by -0.4 percent in the first quarter, marking its weakest quarter since the COVID pandemic began.

Economic growth plodded considerably at the outset of the year. In the concluding three months of 2021, US gross domestic product (GDP) – a broad measure of the economy – grew by only 1.7 percent or 6.9 percent on an annualized basis, local press outlets reported citing Commerce Department figures.

The department attributed the downturn to a surge in imports and a drop in private inventory investment, exports, federal government spending, as well as state and local government spending.

Consumer spending — the largest component of the US economy – grew, however, by 0.7 percent in the first quarter despite the impact of the Omicron wave of the coronavirus pandemic.

The latest report was worse than economists had anticipated and was compiled as the Ukraine conflict led to oil price hikes that continue to impact the economy, and prior to Chinese measures to impose new COVID lockdowns which may further deteriorate supply chain issues.

This is while chief US economist at the London-based Capital Economics, Paul Ashworth, described the slump as “unexpectedly severe,” but added that it was unlikely to deter the Federal Reserve from raising interest rates as it attempts to tackle the growing inflation.

READ ALSO: Israeli forces arrest suspects in the killing of settlement guard in occupied West Bank

“The unexpectedly severe 1.4% annualized decline in first-quarter GDP growth probably won’t stop the Fed from hiking interest rates by 50 basis points next week, since officials will chalk it up to the temporary impact of Omicron and point to the strength of underlying demand,” Ashworth wrote in a note to investors.

The Fed raised rates in March as inflation reached a 40-year high of 7.9 percent. It is due to meet again next week and is expected to increase rates once again. Fed Chairman Jerome Powell has suggested the central bank may raise rates by 0.5 percentage points, marking a two-fold increase of the hike in March.

The surprise drop in growth comes, however, amid a strong showing in other sectors of the US economy as employers have added an average of 600,000 new jobs a month over the last six months, with the unemployment rate dropping to 3.6 percent in March, close to its pre-pandemic low.