The Standard Bank Group operates in more than 20 countries in Africa and abroad. EU Reporter interviewed the bank’s Head of Sustainable Finance Greg Fyfe, to ask him about the importance of the Summit for EU-Africa relations and how it represents a fresh opportunity for the unions to align on climate change after difficult discussions at COP26.

What does the African investment landscape currently look like for European investors?

European investors should note that the investment landscape in Africa is most often characterised by project level initiatives. Development finance capital and equity fund the early stages in the project life cycle, outlining project feasibility and development. Commercial banks, development finance institutions and specialist institutional investors then enter the scene to fund construction and operation phases of the project. Investors should also consider that the Sub-Saharan Africa bond market remains relatively underdeveloped but has the potential to become a principal source of debt financing.

Sustainability linked products saw impressive growth in 2021, and Standard Bank has successfully raised several Sustainable Bonds over the last 2 years. These include a $75m deal to fund Greenlight Planet Kenya, one of Africa’s leading solar energy businesses. The facility is helping to expand access to off-grid solar solutions to communities in Kenya and East Africa.

What are the challenges and opportunities that come with investing in Africa in 2022?

Africa requires more financial support to transition towards a lower carbon economy. This represents a significant investment opportunity for European players. Renewable energy, and specifically the decentralised, off-grid and distributed energy sectors, will continue to grow, as a result of their capacity to promote multiple Sustainable Development Goals.

From a sustainable finance perspective, we are seeing a diversification of product offerings. 2022 will be the year for broadening the green financing product suite, notably in working capital facilities, derivatives and other transactional products. Equity markets will continue to provide incentives for foreign investment into Africa. For instance, the Johannesburg Stock Exchange’s launch of a sustainability segment is helping to attract capital from developed markets.

Challenges emerge with regard to green financing in Sub-Saharan Africa, as climate mitigating projects are at a nascent stage and therefore cannot yet provide a large data base to draw from. This has an impact on the benchmarking used by banks to determine the risk-free premium. Equally, there isn’t yet a continent-wide climate mitigation or adaption framework and standardisation remains an urgent priority. Meanwhile, once the South African National Treasury finalises the Green Finance Taxonomy currently in the pipeline, the pathway to green investments in Africa will be considerably smoother.

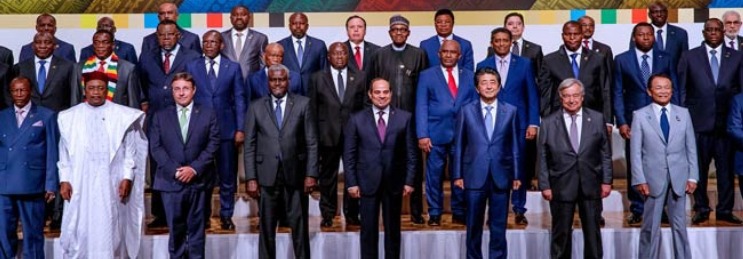

The joint governance of our #AUEU partnership requires transparent monitoring and follow up to check on progress made.

We must be able to assess, on a regular basis, which initiatives are working and which can be improved.#AUEUSummit pic.twitter.com/b3tNuOXtyI

— Charles Michel (@eucopresident) February 18, 2022

How can the EU provide the most valuable assistance to the African continent with regard to the development of infrastructure, transport and green financing?

The EU can and must reaffirm its commitment to investing in the African continent with a robust Africa-Europe Investment Package. The availability of green funding has never been more important for a continent that continues to disproportionately suffer from the climate crisis despite not meaningfully contributing to it.

READ ALSO: U.S: Russia expels U.S.’s second highest official at embassy in Moscow – State Department

The question must also be asked about how relevant the EU Climate Taxonomy is for Africa, a continent which must balance environmental sustainability with social development and infrastructure investment. There also needs to be differentiation between climate adaption and climate mitigation funding. Ideally, the former should predominantly be provided on a donor basis and the latter on a highly concessional basis.

What would a successful Africa-Europe Investment Package look like for both blocs?

A successful Africa-Europe Investment Package is reliant on a number of factors, but at its crux, it must include actionable plans to deliver on previous promises. To do this, the size of any investment package is highly relevant, with the investment flows into Africa needing to increase significantly.

There also needs to be differentiation between climate adaption and climate mitigation funding. Ideally, the former should predominantly be provided on a donor basis and the latter on a highly concessional basis.

How important is the European Investment Bank in EU-Africa relations?

Like all investment initiatives, the EIB has the potential to greatly enhance EU-AU relations, but it is important that any financial packages are sufficiently targeted. The EIB $24.6m investment in Alitheia IDF, one of the first and few women-focused investment funds in Africa, is a good example of how the fund can work towards providing wider financial and socioeconomic benefits to Africa.